What is Trucking Insurance?Much like any other vehicle you drive, you must ensure your truck. Any number of things can happen on the road, including collisions, theft, and damage to the cargo being shipped. Unlike your personal automobile, additional concerns include whether or not you are carrying hazardous materials, excess weight, and potential damage to the truck itself. It is important to consider your needs carefully before purchasing a policy, especially if you are a business owner, are hauling hazardous materials, or drive a particular type of truck (e.g., dump truck, cement mixer, etc.).

Trucking Insurance Coverage OptionsAuto and boat hauling insurance- This option provides protection for drivers, passengers, vehicles, and cargo involved in the transportation of cars and boats, including clearance risks, damage to cars, and theft of vehicles or parts. Rates may vary, especially with regard to luxury vehicles, and should be discussed with your broker.

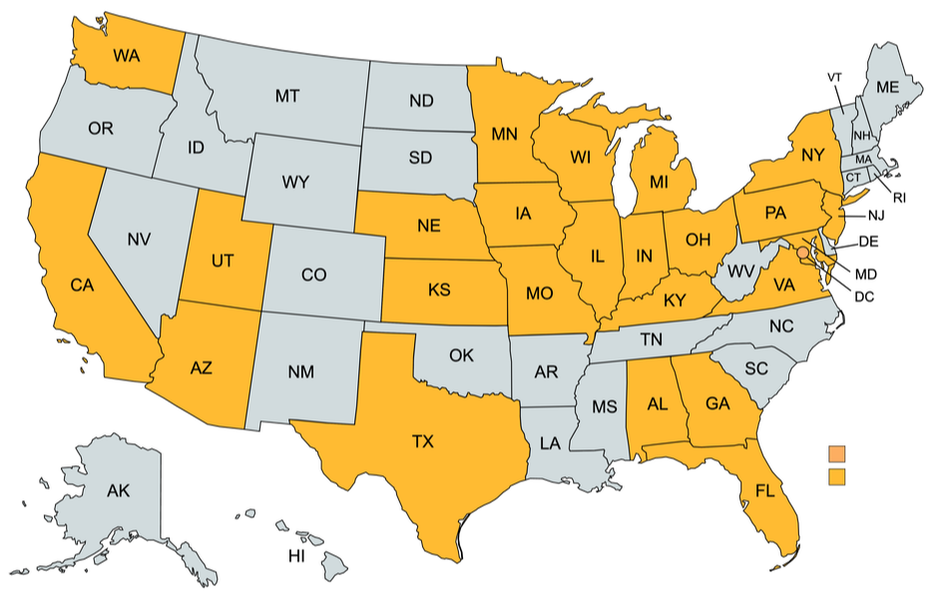

Box truck/straight truck insurance- There are two coverage options for box/straight trucks, depending on whether you own the truck, or if you are a for-hire trucker. As an owner, you will want to purchase coverage to protect damage to the truck, the people, and the property involved for an at-fault accident. For-hire truckers may want to consider options to protect the goods being hauled and protection of your truck when not under dispatch. Box/straight trucks include cargo cutaway, ice boxes, moving trucks, refrigerated (reefer) trucks, sleeper boxes, and tilt cabs, among others. Commercial truck insurance- This option covers bodily injury to persons injured by your truck or while on your property, damage caused to the property of another by your truck, costs and damages incurred with incorrect deliveries, driver accidents at delivery locations, and lawsuits involving slander, libel, or false advertising involving your business. Cargo insurance (also known as motor truck cargo insurance)- This option covers the liability of the policyholder for destruction, damage, or other loss of the cargo being shipped. A variety of coverage options are available, depending on the type of cargo, and should be discussed carefully before purchase. Cargo van insurance- This option protects protection for the van driver, passengers, and commercial van contents. The types of vans we cover include box vans, cargo vans, courier vans, passenger vans, refrigerated vans, and step vans. Dry van insurance- This option protects drivers, vehicles, passengers, and cargo involved in transporting the trailers carried by bobtails. This option is ideal for when no refrigeration is required, and no specific requirements for transport are present. As the trailers used generally do not belong to the trucking company, this is an important coverage option and will protect against concerns including fire, theft, and vandalism. Flatback- This option protects drivers, passengers, vehicles, and cargo involved in transport using flatbed trucks, including damage and theft. Other risks it may cover include damage or injury resulting from load securement (e.g., poor securement, loading and unloading injuries), accident or cargo loss is resulting from dangerous or oversized loads, accidents resulting from driving empty beds, and ramp, chain, tarp, and binder coverage. Hazmat driver- This option covers drivers, passengers, and vehicles that transport hazardous materials or waste. It generally includes pollution coverage. This coverage will vary depending on the type of material being hauled, how it is transported. Hazardous materials may include explosives, gasses, flammable liquids and solids, corrosives, radioactive materials, toxic and infectious substances, oxidizing substances. And organic pesticides. Interstate driver- This option coves drivers, passengers, and vehicles that transport cargo that will ultimately leave the state of origin, engaging in interstate commerce. Different states will have different regulations around insurance requirements, and this will protect the driver in every state. Local driver- This option protects a driver, passengers, truck, and cargo for truckers driving in a limited (local) area. To determine the mileage radius, discuss this option with your broker. Vehicles that may be covered include dry vans, reefer vans, flatbeds, non-hazardous liquids, and hazardous commodities. Refrigerated (Reefer) driver- This option covers the cargo of refrigerated trucks. As many transport perishable foods and beverages, spoilage to products may occur if a truck breaks down, is damaged, or there is a mechanical failure. Of note, certain products may not be covered (e.g., meat, seafood, pharmaceuticals) and should be discussed with your broker. RV hauling- This option covers drivers, passengers, and vehicles involved in hauling a recreational vehicle. This protects the driver, truck, and RV from damage, theft, or injury. The Department of Transportation has specific guidelines around legal minimums for coverage and should be discussed with your broker. Tanker driver- This option provides coverage for drivers, passengers, trucks, and product damage to tanker trucks transporting liquids. These trucks generally come with specific risks, including leakage, hose detachment upon loading and unloading, potential pollution risks with spills, or explosions with flammable cargo. Vehicles covered include chemical, dry nitrogen, gas, milk, natural gas, oil, and water haulers. Coverage includes pollution liability, debris removal, and specified peril (may include fire damage, etc.). Tow truck insurance- This option provides coverage for drivers, passengers, and vehicles involved in the operation of a tow truck. Businesses providing towing services are required to carry towing insurance and include auction haulers, auto body shops, auto club contractors, auto repair shops, roadside assistance providers, and salvage haulers. Other recommended coverage options include garage keeper's legal liability coverage to protect against vehicle damage while a vehicle being serviced is stored, and on-hook towing insurance, to protect drivers from damage, collision, theft, or vandalism to the vehicle being towed while in motion. Tractor insurance- This option provides coverage to drivers, passengers, and the tractor itself. Losses and damages included in this protection include fire, theft, vandalism, collision, wire damage from rodents, and damage from the weather (e.g., hail, lightning, snow, wind). Transportation insurance- This option covers drivers, passengers, and vehicles for businesses using trucks, vans, or cars to transport goods or passengers from injury or damage resulting from collisions, accidents, as well as damage resulting from theft or vandalism. Truck liability- This option provides coverage from damage or bodily injuries to others as a result of an accident. Of note, minimum coverage may vary, depending on the weight of the truck, per federal law. Trucker insurance- This option provides coverage for drivers, passengers, and vehicles involved in driving a commercial truck. Coverage may vary depending on the type of truck driven, whether the driver is also the owner-operator, the type of cargo being hauled, the age and value of the truck, and the driver’s driving history, and should be discussed with a broker to determine the correct level and type of coverage. Trucking fleet insurance- This option will vary depending on the number of trucks in a fleet, the size of the trucks, the type of trucks, the type of cargo being transported, and whether or not transport is interstate or intrastate. Options include gross revenues policies, where a monthly pre-arranged premium rate is charged, based on revenue, mileage-based policies, or per vehicle premiums for smaller fleets. Coverages We OfferBailee liability- This option covers the damage or destruction of a vehicle while in possession of or use of someone other than the owner. It covers fire, theft, collision, burglary, weather-related events, and damage caused during transportation. There are varying levels of coverage available and should be discussed with your broker.

Commercial property insurance- This option covers the risk of loss or damage to an organization's buildings, grounds, or personal property of the insured or others on site. Coverage can be provided on an all risk or specific perils basis. Employment practices liability coverage (EPLI)- This option protects businesses against legal action claims by their employees, including sexual harassment, wrongful termination or discipline, breach of contract, discrimination, and failure to promote. Policies will vary, but generally include legal costs, judgments, and settlements. Excess liability- This option provides limits to a policy that exceeds the original, providing higher limits. This policy is employed when all other resources have been tapped, and additional coverage is needed to cover the remaining costs. Please note, this differs from umbrella coverage. Hired auto liability- This option covers damage to vehicles or property or injury to drivers and passengers involved in an accident where a “hired” vehicle is used to conduct business or transport. This may include rented, leased, or borrowed vehicles. Non-owned auto liability- This option covers damage to vehicles or property or injury to drivers and passengers involved in an accident where the driver uses their personal vehicle for business purposes. The driver must also carry their own insurance, which will be applied first when a claim is made. Non-trucking liability- This option provides coverage for a driver against any property damage or bodily injury resulting while a driver is on personal time. Physical damage- This option covers loss or damage to your truck resulting from a collision with another vehicle or object. This may be required as opposed to optional, depending on the policy already in place. If you have a collision policy, physical damage resulting from a collision is covered. A comprehensive policy, however, will generally include non-collision damage, theft, and fire coverage. Primary auto insurance- Primary auto insurance is required for for-hire truck drivers operating on their own. It is a basic coverage option that protects injuries and damages to other people, vehicles, and property if you are at fault for an accident, in addition to legal defense costs if legal action is taken against you. Primary coverage must be placed on all vehicles on a policy. Each state will have its own minimum requirements, and this should be discussed with your broker. Trailer interchange insurance- This option covers any damage involved with the use of a trailer you do not own. Worker’s compensation- This option provides protection against injury for employees of a trucking company. This is required by law. |

|

Navigation

|

Connect With Us

|

Contact Us

Publix Insurance Agency

201 E Army Trail Rd. Ste 210 Bloomingdale, IL 60108 (630) 550-0150 Click Here to Email Us |

Location

|