Automobile LiabilityWith the wide variety of insurance coverage options available to trucking companies, the glossary of terms used can get confusing quickly. It’s easy to make the assumption that your current insurance policy will cover not only you or one of your drivers, but also third-party people and property that may be harmed or damaged in an accident. The fact is, additional coverage is required by law, especially if you are a for-hire trucker or a motor carrier. This is called automobile or truck liability, and it protects a driver who injures another person or damages property while driving. It is important to remember is that this option covers only the third-party group and not the driver involved, and the insured must also have primary liability coverage in place as well. With this policy, the following coverages are provided:

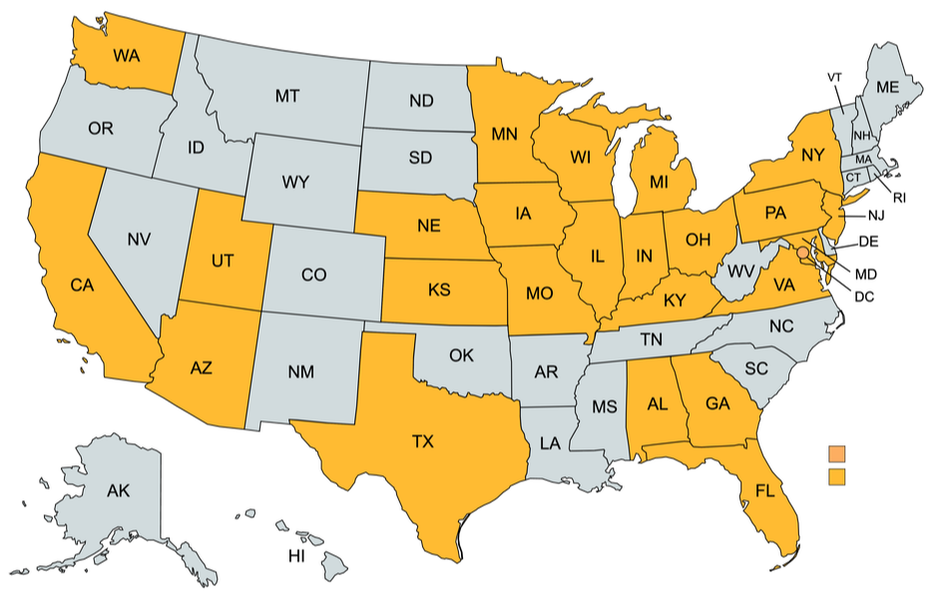

State and federal regulations stipulate that a minimum of $750,000.00 in automobile or truck liability coverage be purchased. This, however, may not be sufficient, as certain shippers and brokers often require higher amounts to protect potential damage to cargo. Additionally, purchasing a higher coverage amount ensures that all costs incurred from a claim can be paid out without requiring further unbudgeted expenditures. Other coverage scenarios include third-party injuries on your property, damage to third party rental property (e.g., fire), damage resulting from incorrect product delivery, libel and slander, and injury or damage caused by driver conduct while in service (e.g., at weigh stations, truck stops, etc.). Another factor to consider is the purpose of the trucks in your fleet. If your company transports hazardous materials, additional coverage will likely be required. Excess or umbrella policies may also be needed to ensure adequate coverage. Restrictions and exceptions will vary from state to state and may include vehicle types, mileage radius, states, and situations. These should be discussed and clarified with your broker. |

|

Navigation

|

Connect With Us

|

Contact Us

Publix Insurance Agency

201 E Army Trail Rd. Ste 210 Bloomingdale, IL 60108 (630) 550-0150 Click Here to Email Us |

Location

|