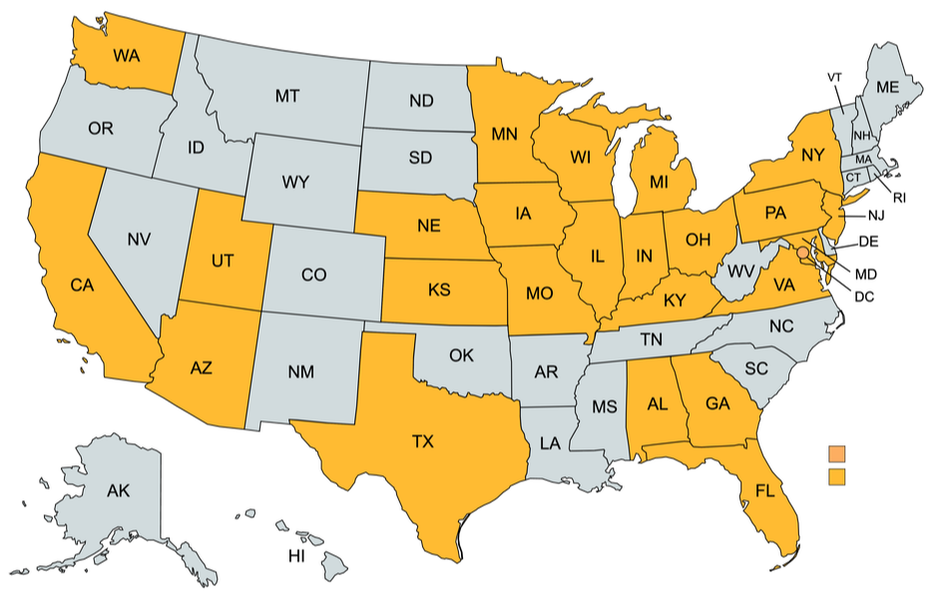

What is Flood Insurance?Flood insurance specifically protects against property loss from flood damage. To determine risk factors for specific properties, insurers will often refer to topographical maps that denote lowlands, floodplains, and floodways that are susceptible to flooding.

More About Flood InsuranceFlooding is defined by the National Flood Insurance Program as the general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or two or more properties (at least one of which is your property) from overflow of inland waters, unusual and rapid accumulation or runoff of surface waters from any source, and mudflows.

Flooding can be brought on by landslides, hurricanes, earthquakes, or other natural disasters. A homeowner must hold flood insurance specifically, regardless of the cause. For example, despite carrying earthquake coverage, a homeowner is not protected against floods resulting from an earthquake. Nationwide, only 20% of American homes at risk for floods are actually covered by flood insurance. Most private insurers do not insure against the peril of flood, due to the prevalence of adverse selection, which is the purchase of insurance by persons most affected by the specific peril of flood. Contact us to learn more about the right amount of flood coverage for your home. |

|

Navigation

|

Connect With Us

|

Contact Us

Publix Insurance Agency

201 E Army Trail Rd. Ste 210 Bloomingdale, IL 60108 (630) 550-0150 Click Here to Email Us |

Location

|